ArcheAge Unchained was released only two weeks ago on October 15th and then on 18th on Steam.

I went back and read my article posted on Oct 1 and so much has happened over those past two weeks.

For starters, Gamigo had only planned to open 3 servers per regions:

- NA: Tyrenos, Wynn and Denistrious

- EU: Alexander, Halnaak and Belstrom

As I write today we now have 6 servers on NA and 5 on EU. While this reflects the interest of the gaming community towards the game and is a healthy measure, it also brings some red flags to me, more on that later.

Depending on who you read or listen to on YouTube and Twitch, you’ll hear that the launch was a smooth and successful one or that it was terrible. I let you be the judge of that but here was my experience and on a scale of 1 to 10, I’d give it a 4:

1st red flag: Name Reservation

Gamigo offered Founders the ability to reserve a spot and name on a server of choice on Saturday 12th October (this was delayed by a week).

Being Australia based, that 10am PDT on 12th was 4am on 13th for me; and as a true committed Aussie gamer I got up early so I could reserve my name and spot on our chosen server: Wynn.

Within 20 minute of the servers opening up, I was horrified to see some races and then West faction locks being activated. The consequences: two of our friends who were still stuck in a very long queue (into the thousands) were not able to create their characters on the same server as us. About 1 hour later the whole server was in lock down. Shortly later so were Tyrenos and then Denistrious.

2nd Red flag: Servers locked

This made no sense to me. Why? Because all the people who were there were Founders. Gamigo knew exactly how many accounts that represents. With up to 2 characters per account they should have know those servers were going to fill up fast. They should have opened at least 4 servers per region.

The only thing they would not be able to measure, was how many characters created on a server were there as place holders vs. genuine players. Some guilds had instructed their members to create one character on Tyrenos and one on Wynn for example. Others were to create a character in each faction (one being an alt). Faction balance is very important in an Open World PvP game. Gamigo knows that and attempted to ensure balance. As it turns out, that same effort contributed to the faction imbalance currently experienced on Wynn and other servers.

Instead of adding 4th servers before the official launch, Gamigo chose to re-open the doors at the same time on the Sunday and Monday. Once again, those doors shut within 10 min while people were stuck in queues, including our friends. By then rage and outrage was building up across Reddit, Discord and Twitter. How could they miss the mark so much?

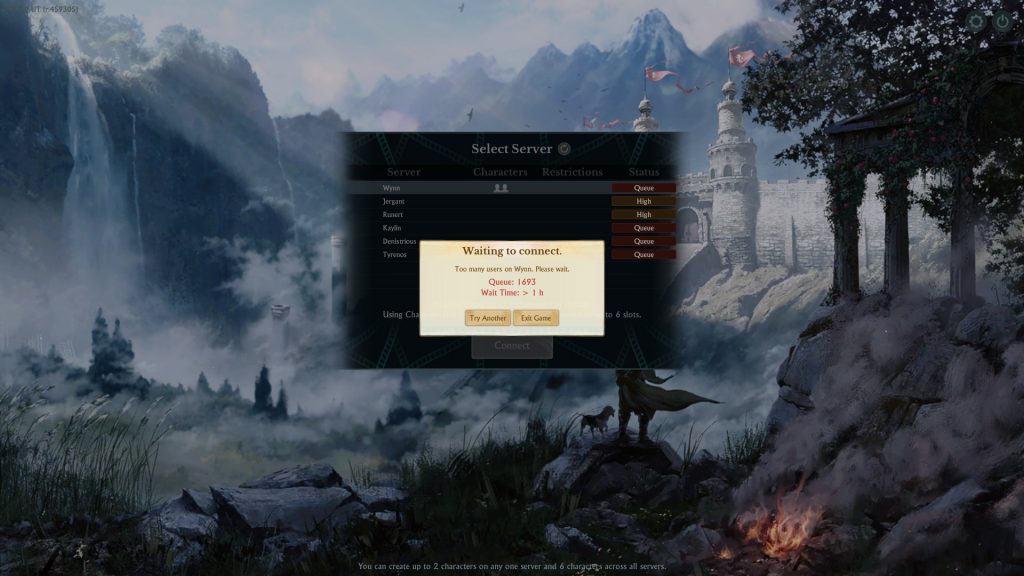

When we got to launch day, October 15th (4am ob 16th for me), most of us started to experience what was going to become our daily frustration: Queues.

I experienced queues closed to 4000 every day. What has been the most frustrating has also been the frequent server connections loss. No warning, no error message. You have to stare at the number in the queue to see if it is still ticking down or not. If not, I have to exist and start all over again. Gamigo promised us grace period that would allow people to rejoin the queue rather than be thrown at the back. Sadly, that has not been implemented yet. Even when it does (hopefully soon!), there is no certainty this will help much because of the lack of warning when losing that server connection.

The impact of these queues has been beyond frustrating. It can take me 9 hours to get in game. During which time I need to be careful not to create any kind of lag on my PC and risk another disconnect.

3rd Red Flag: The ArchePass

To remove the P2W model, the ArchePass provides the means to earn Diligence coins. These coins can then be spent in the in game store to buy critical items such as labor recharge and inventory space. So it is clear that the ArchePass is at the core of AA Unchained.

We didn’t get the opportunity to fully test it during the 2 weeks on PTS. The issue that had transpired at the time was to have to re-purchase the dailies when switching between ArchePasses. The irony is that this cost might have limited the number of people who exploited the ArchePass’ weak design. These people re-rolled the World Boss daily quest by switching ArchePass and were earning 50 gold per quest, up to 800 gold a day! Ultimately, this earned them a ban (more on that below). Maybe the ArchePass shouldn’t have had any gold rewards in the first place!

The ArchePass came with such limited pool of dailies that it would hand out the same quests over and over, including the World Boss one. Even those people that did not technically exploit made a lot of money from this as well as acquired Labour Rechargers and Diligence Coins. Good on them but the damage is done because most people did not. This results in significant faction imbalance and a two tier economy. We have now more people top gear score because they had the gold and labour to do it. They also have the Gilda coins to get the warships and can now do Abyssal and Ghost ships, which are big money makers and will further deepen the gap.

In the meantime, people who didn’t know about this ArchePass flaws have been growing Cedar trees and crops on their farms. They’ve been mining and doing a few trade runs and making 50g a day and their gear score is half that of the top players.

4th red flag: The Bans

Due to community outcry about how the ArchePass was being “used” by some guilds and faction, Gamigo assessed the situation. On 22nd October they issued a hotfix to reduce the World Boss quest reward from 50g to 10g. They also announced that 200 accounts were being banned, including some high profile streamers. The problem is that a few hours later an unknown (yet seemingly large) number of those bans were lifted because Gamigo admitted they couldn’t ban people who did not actually intentionally flipped between ArchePasses to re-roll the World Boss quest. While I agree it isn’t fair to ban people for game design flaws, doing a ban and then back pedalling on it, results in a huge loss in confidence and credibility.

Then on 24th October, Gamigo decided to disable the ArchePass for an undetermined period. The community is divided on this decision. Some say that without the ArchePass people now won’t have a chance to close the gap. Others want it removed until it is returned into a better, fairer and balanced format. The ArchePass dailies also had turned into a time consuming demanding activity that took away the sandbox aspect of the game.

Where are we at now?

Yesterday, Gamigo announced that they will offer a one time claim per account of 300 diligence coins. They also announced Maintenance across all servers, today 30th. They are also wisely considering granting that 300 Diligence Coin overtime rather than as a lump sum.

The queues are about half of what they were a week ago, but the server time out is frequent and discouraging. A few people have re-rolled on lower populated servers and quite possibly a few have given up. Today’s patch should improve queue grace handling while grace period is still being tested and not fully implemented.

ArcheAge is still the best MMO I have played. The graphics are stunning. The look of the different regions is diverse and breathtaking in some cases. The immersion is awesome and the combat mechanics and effects are the best I have experienced. Yet, the shape of the ArchePass when it is returned will most likely define the fate of ArcheAge Unchained.

How Gamigo sets expectations and manages a rather aggressive community will be critical. In all fairness, their handling of the issues has been professional and quite transparent. They recognised their errors and are committed to fixing them. Khrolan, the Executive Producer, has taken ownership and has been hands on during the whole process.

If you want to give ArcheAge a shot, make sure you go to the most recent server, join a guild and learn the ropes with them. Otherwise wait a few more weeks or months to see how things shape up. This is a game where knowledge is power. There are a lot of resources available on YouTube and Discord channels but beware as some are out of date or inaccurate.

Feel free to join me during one of my streams on: http://twitch.tv/FrenchGirlGaming and ask questions.

Disclaimer: I am not an employee of Gamigo, Trionworlds, XLGames or related to any employees. This article is not sponsored by anyone. This is the results of my own research and own opinions.